The financial world is undergoing a significant transformation, with the traditional banking sector increasingly looking towards the innovative possibilities offered by Web3 technologies. While the concept of “staking” is typically associated with decentralized cryptocurrencies, JPMorgan, a titan of traditional finance, is exploring how to bridge this gap through its JPMORGAN token ecosystem. This article delves into the hypothetical yet insightful concept of “staking” with JPMorgan, examining how a centralized financial institution might implement gamified rewards programs to incentivize client engagement, foster adoption of its digital services, and reward participation in its blockchain-based initiatives, even if it’s not “staking” in the conventional crypto sense.

The Evolution of Financial Engagement: Bridging TradFi and Web3

The rapidly evolving financial landscape is witnessing a convergence of traditional finance (TradFi) and Web3 technologies, including blockchain, cryptocurrencies, and digital asset tokenization. Traditional financial institutions are adapting to align with the next generation of the digital economy. The JPMORGAN Token Ecosystem represents a significant step in this direction, aiming to create a bridge between conventional financial structures and decentralized digital economies. This token is designed as a community token for fans, advocates, and users who support financial innovation inspired by JPMorgan. It’s crucial to understand that the JPMORGAN token is not a direct representation of the bank itself, but rather draws inspiration from JPMorgan as it ventures into the Web3 space.

The core functionalities of the JPMORGAN token include enabling fast, secure, and low-cost payments, facilitating interactive loyalty programs, and serving as a versatile digital asset within blockchain-based ecosystems. Users can leverage JPMORGAN tokens for staking with gamified rewards, generating NFT-based payment receipts, tracking transactions via smart contracts, and participating in various decentralized activities. This highlights a forward-thinking approach where traditional financial principles are enhanced through blockchain technology.

Understanding the JPMORGAN Token and Its Foundation

The JPMORGAN token is developed as a robust digital asset based on globally accepted blockchain standards, prioritizing security, scalability, and interoperability. Its core specifications include “JPMorgan Token” as the name, “JPMORGAN” as the symbol, and it’s built on the BEP-20 standard. The total supply is fixed at 50,000 tokens, with 18 decimals, and the smart contract has been audited by PeckShield. The circulating supply is also 50,000 tokens.

The JPMORGAN token is primarily implemented on Binance Smart Chain (BSC), with plans for future cross-chain capabilities to enhance interoperability with other blockchain networks, including Ethereum. The smart contract incorporates multi-layered logic with advanced features such as token freezing mechanisms, customizable vesting schedules for controlled distribution, sophisticated staking reward systems with algorithmic distribution, automated airdrops, and on-chain transaction analytics for transparency. Notably, it also includes built-in KYC compatibility for regulatory compliance. The ecosystem is designed to be community-focused, offering governance rights to fans and advocates of financial innovation.

Beyond Traditional Staking: Gamified Rewards and Engagement

While the term “staking” in the cryptocurrency world typically refers to locking up tokens to support network operations and earn rewards, JPMorgan’s approach, as outlined in the whitepaper, leans heavily into “gamified rewards”. This transforms traditional financial activities into engaging, reward-based interactions that incentivize continued participation. Gamification serves as a central mechanism, allowing users to engage in activities such as score mining, earning seasonal rewards, collecting digital certificates in the form of NFTs, and contributing to a dynamic, decentralized environment that incentivizes participation and loyalty.

The JPMORGAN token ecosystem implements a sophisticated staking mechanism that rewards long-term holders and contributes to ecosystem stability. Staking serves as both a reward system for token holders and a stabilizing mechanism for token velocity and price action. When users stake their JPMORGAN tokens, they receive multiple benefits:

- Base yield rewards: Distributed periodically (weekly or monthly) based on the staked amount and duration.

- Boosted governance rights: Voting power scales with staking duration.

- Priority access: To new features, promotional campaigns, and exclusive content.

- Tiered status levels: Unlocking progressive benefits and higher reward multipliers.

- Special NFT rewards: Available exclusively to stakers who meet specific criteria.

The staking mechanism includes different tiers with varying minimum stake requirements, lock periods, and Annual Percentage Yields (APYs), along with special benefits:

- Bronze: 50 JPMORGAN minimum stake, 30-day lock, 5% Base APY, basic voting rights.

- Silver: 200 JPMORGAN minimum stake, 90-day lock, 8% Base APY, 1.5x voting power, monthly NFT drops.

- Gold: 500 JPMORGAN minimum stake, 180-day lock, 12% Base APY, 2x voting power, premium NFTs, early feature access.

- Platinum: 1000 JPMORGAN minimum stake, 365-day lock, 18% Base APY, 3x voting power, exclusive NFTs, direct development input.

A dynamic reward calculation algorithm adjusts based on factors like the total percentage of circulating supply staked, average staking duration, network activity, and seasonal modifiers. This adaptive approach ensures sustainable rewards regardless of market conditions. Staked tokens are secured through a time-locked smart contract, and while staked, they cannot be transferred or sold, but stakers have full visibility through the dashboard interface. Emergency unstaking options exist with penalty mechanisms to discourage premature withdrawal.

In your opinion, what is the most significant challenge in implementing such a dynamic and gamified staking model within a traditional financial institution’s ecosystem?

The Gamified Journey: How Rewards Unfold

The JPMORGAN token ecosystem’s gamification framework is designed to drive engagement, reward participation, and create an interactive financial experience. This innovative approach transforms traditional financial activities into engaging, reward-based interactions that incentivize continued participation.

Key gamification mechanics include:

- Daily Financial Tasks: Simple daily activities that generate small token rewards.

- Achievement Unlocking: Milestone-based rewards for meeting specific ecosystem goals.

- Seasonal Competitions: Time-limited campaigns with substantial rewards for top performers.

- Loyalty Tiers: Progressive status levels with increasing benefits for long-term participation.

Beyond these, the system incorporates sophisticated mechanisms like:

- Score Mining: Users earn points through active ecosystem participation, including transactions, governance voting, and community contributions, which contribute to rankings and eligibility for periodic token rewards.

- Quest Completion: Structured financial activities presented as quests with clear objectives and corresponding rewards, ranging from educational challenges to strategic token utilization tasks.

- Digital Collectibles: NFT-based achievements and milestones that serve as status symbols and potential value-accruing digital assets.

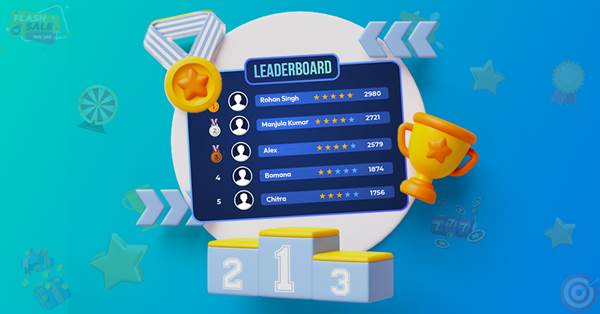

- Leaderboards and Rankings: Competitive elements that showcase top performers, creating social recognition for active participation.

The gamification design prioritizes substance over superficial engagement, ensuring that these activities contribute meaningful value to both the participant and the broader ecosystem. The reward mechanisms are carefully calibrated to align user incentives with ecosystem health and long-term sustainability.

The Role of NFTs: Beyond Collectibles

A distinctive technical feature of the JPMORGAN ecosystem is the implementation of NFTs as blockchain-based transaction receipts or payment records. This innovation enables unprecedented transparency and verifiability in financial operations, creating an immutable record of transactions for both practical and regulatory purposes.

The primary NFT applications within the JPMORGAN ecosystem extend beyond typical collectible uses:

- Transaction Receipts: Every significant transaction generates an NFT receipt, serving as an immutable record containing critical information like parties, amounts, timestamps, and purpose. These digital receipts provide unprecedented transparency for accounting and compliance, while maintaining appropriate privacy controls.

- Achievement Certificates: Users earn achievement NFTs by reaching specific milestones or completing challenges, serving as verifiable proof of accomplishment and potentially conferring special privileges or status.

- Governance Credentials: Specialized NFTs represent governance participation rights and voting history, helping establish reputation within the governance system and creating a transparent record of an individual’s contribution to ecosystem development.

The technological implementation of NFTs leverages metadata-rich token standards for efficient information storage, and smart contract integration ensures automatic generation and distribution. Unlike purely speculative NFT applications, the JPMORGAN approach focuses on utility and functionality. While these NFTs may accrue value based on rarity, their primary purpose is to enhance ecosystem functionality through verifiable digital certificates.

The Benefits: For Clients and JPMorgan

This innovative approach to “staking” and gamified rewards offers a multitude of benefits for both clients and JPMorgan.

For Clients:

- Enhanced Engagement and Rewards: Clients are incentivized to engage more deeply with JPMorgan’s digital services through tangible rewards, beyond traditional interest rates or cashback.

- Transparency and Verifiability: NFT-based transaction receipts offer unprecedented transparency and immutability for financial records, simplifying accounting and tax reporting.

- Financial Literacy and Education: Gamified challenges centered around financial literacy can educate users on various financial concepts in an engaging manner.

- Community and Influence: Token holders gain governance rights, allowing them to propose and vote on critical ecosystem decisions, fostering a sense of ownership and community.

- Access to Premium Features: Staking can unlock access to exclusive content, reports, analysis tools, and discounted fees on partner platforms.

- Loyalty and Retention: Tiered loyalty programs and long-term staking incentives encourage continued participation and deepen the relationship with the ecosystem.

For JPMorgan:

- Increased Digital Service Adoption: The gamified incentives drive greater adoption and utilization of JPMorgan’s Web3 initiatives and digital platforms.

- Client Loyalty and Retention: By offering unique and interactive rewards, JPMorgan can foster stronger client loyalty and reduce churn.

- Data-Driven Insights: On-chain transaction analytics and user engagement data from gamified activities provide valuable insights into client behavior and preferences, enabling more tailored service offerings.

- Innovation and Brand Leadership: Implementing such a system positions JPMorgan at the forefront of financial innovation, bridging traditional finance with decentralized technologies.

- Cost Reduction: Fast settlement and minimal fees for token-based payments compared to traditional payment rails can lead to operational efficiencies.

- Regulatory Compliance and Transparency: The built-in KYC compatibility, smart contract audits, and NFT receipts provide a robust framework for regulatory compliance and enhanced transparency.

- Ecosystem Growth: Strategic partnerships and the expansion of token utility will further enhance the ecosystem’s value proposition, attracting more users and developers.

Consider a hypothetical scenario: Sarah, a small business owner, uses JPMORGAN tokens to pay for business services on a partner platform. Each payment generates an NFT receipt, simplifying her accounting. Simultaneously, her consistent use and participation in financial literacy quizzes (gamified tasks) earn her additional JPMORGAN tokens and unlock a higher loyalty tier, granting her discounted fees on future services. This example illustrates the practical utility and rewarding nature of the ecosystem.

Practical Tips for Engaging with the JPMORGAN Ecosystem (Hypothetical)

For those interested in engaging with a similar ecosystem, here are some practical tips, drawing from the JPMORGAN whitepaper’s principles:

- Start with the Basics: Begin with basic engagement activities, such as completing daily financial tasks or educational quizzes, to earn initial rewards and familiarize yourself with the platform’s mechanics.

- Explore Staking Tiers: Evaluate the different staking tiers and their associated benefits. Choose a tier that aligns with your financial goals and the duration you’re comfortable locking your tokens for. Remember, higher tiers generally offer greater rewards and governance influence.

- Understand NFT Utility: Don’t just view NFTs as collectibles. Recognize their functional value as immutable transaction records and achievement certificates. Utilize them for personal record-keeping or for demonstrating participation.

- Participate in Governance: If governance rights are appealing, actively participate in proposal discussions and voting. Your vote can influence the ecosystem’s future development and direction.

- Stay Informed: Regularly check official communication channels for updates on new features, gamified campaigns, and partnership announcements. This will help you maximize your rewards and engagement opportunities.

- Prioritize Security: Always enable multi-factor authentication, be wary of phishing attempts, and practice secure management of your digital assets.

- Monitor Your Progress: Utilize the ecosystem’s dashboard and mobile application to monitor your token balances, track staking rewards, and manage your NFTs in real-time.

Key Takeaways

- The JPMORGAN Token Ecosystem aims to bridge traditional finance with Web3 technologies, offering a community token inspired by JPMorgan’s financial innovation.

- “Staking” within this ecosystem refers to locking JPMORGAN tokens to earn gamified rewards, boosted governance rights, and access to premium features.

- The token features a fixed supply of 50,000 JPMORGAN tokens and is built on the BEP-20 standard, with plans for cross-chain interoperability.

- Gamification is central, with activities like daily financial tasks, achievement unlocking, seasonal competitions, and loyalty tiers designed to incentivize participation.

- NFTs play a functional role, serving as immutable transaction receipts, achievement certificates, and governance credentials.

- The system prioritizes security through rigorous smart contract audits, multi-layered architecture, and continuous security enhancements.

- The project emphasizes legal compliance with KYC/AML protocols and a multi-jurisdictional legal strategy.

Conclusion

The JPMORGAN token project represents a significant stride in demonstrating how traditional financial principles can be enhanced through blockchain technology, setting a new standard for community-driven financial tokens. By offering a sophisticated blend of secure infrastructure, innovative gamified rewards, and a robust governance model, the ecosystem seeks to create a more interactive, transparent, and rewarding financial experience for its participants. It is a testament to the evolving nature of finance, where the best of both traditional and decentralized systems are being combined.

The journey outlined in the JPMORGAN whitepaper is just the beginning. As the ecosystem expands through community participation, technological advancements, and strategic partnerships, the JPMORGAN token’s utility and impact are poised to grow. This initiative invites financial enthusiasts, blockchain innovators, and forward-thinking investors to join in building the next generation of financial experiences, inspired by traditional excellence and enhanced by decentralized innovation.

Share your thoughts on this innovative approach to financial engagement in the comments below! What excites you most about the convergence of TradFi and Web3? Share this article with your friends and colleagues who are interested in the future of finance.