Dive into the world of Non-Fungible Tokens (NFTs) as we demystify these unique digital assets and uncover their transformative applications across the financial landscape. From investment opportunities to innovative lending, discover how NFTs are reshaping the future of finance.

Understanding the Basics: What Exactly is an NFT?

At its core, an NFT, or Non-Fungible Token, is a unique digital asset that represents ownership of a specific item or piece of content,1 recorded on a blockchain. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are “fungible” (meaning each unit is interchangeable with another), NFTs are distinct and cannot be replaced by an identical item. Think of it like this: if you trade one Bitcoin for another, you still have the same value; but if you trade a unique piece of digital art for another, you’re getting something entirely different. This inherent uniqueness is what gives NFTs their value and opens up a new realm of possibilities in the digital world.

NFTs leverage blockchain technology to ensure authenticity and ownership. Each NFT has a unique identifier that is recorded on a blockchain, making it verifiable and transparent. This record includes information about its creator, owner, and transaction history, providing an immutable proof of provenance. This transparency and immutability are crucial for establishing trust and value in digital assets.

The Role of NFTs in the Evolving Financial Landscape

The financial landscape is rapidly evolving, with blockchain, cryptocurrencies, and digital asset tokenization becoming increasingly pivotal. NFTs represent a significant step in bridging conventional financial structures and decentralized digital economies. While often associated with digital art and collectibles, NFTs are extending their reach into more practical and transformative financial applications. This shift highlights their potential to not only represent ownership but also to facilitate new forms of financial interaction and record-keeping.

Core Characteristics of NFTs that Drive Financial Innovation

The unique characteristics of NFTs make them particularly well-suited for innovation within the financial sector.

Uniqueness and Scarcity

Each NFT is one-of-a-kind and cannot be replicated, which creates digital scarcity. This inherent scarcity is a fundamental driver of value, similar to physical rare assets. In a world of infinite digital copies, NFTs provide a mechanism for verifiable originality.

Verifiable Ownership and Authenticity

Built on blockchain technology, NFTs provide an immutable and transparent record of ownership. This eliminates the need for intermediaries to verify authenticity, reducing fraud and increasing trust in digital transactions. For financial applications, this means clear and undeniable proof of who owns what.

Immutability and Transparency

Once an NFT is created and recorded on the blockchain, its data cannot be altered or deleted. This immutability ensures the integrity of financial records and transactions. The transparent nature of public blockchains means that all transactions are visible and auditable, fostering greater accountability.

Programmability

NFTs are powered by smart contracts, which are self-executing contracts with the terms of the agreement directly written into2 code. This programmability allows for advanced functionalities, such as automated royalty payments to creators, conditional transfers, or integration into complex financial protocols.

In your opinion, which of these characteristics do you believe will have the most significant impact on traditional finance?

Diverse Applications of NFTs in the Financial World

Beyond the realm of digital art, NFTs are finding innovative applications in various financial sectors, offering new ways to manage assets, facilitate transactions, and even reshape traditional financial instruments.

Digital Payments and Transaction Records

One of the revolutionary features being explored is the use of NFTs as blockchain-based transaction receipts or payment records. This innovation enables unprecedented transparency and verifiability in financial operations, creating an immutable record of transactions that serves both practical and regulatory purposes. For instance, the JPMORGAN token ecosystem allows users to generate NFTs as immutable transaction records and ownership proofs. These digital receipts can be used for accounting, tax reporting, and verification purposes, bringing unprecedented transparency to financial operations.

Loyalty Programs and Gamified Finance

NFTs can power interactive loyalty programs and gamified rewards within blockchain-based ecosystems. For example, long-term holders and active participants can earn bonuses through tiered loyalty systems, where different holding periods and activity levels unlock progressively valuable rewards. Gamification serves as a central mechanism, allowing users to engage in activities such as score mining, earning seasonal rewards, and collecting digital certificates in the form of NFTs. These gamified elements can include completing financial literacy quizzes, participating in trading competitions, and engaging with educational content to earn additional tokens or exclusive NFTs.

Staking and Yield Generation

NFTs can be integrated into staking mechanisms, where users lock up their tokens to earn rewards and contribute to network stability. Staking benefits can include base yield rewards, boosted governance rights, priority access to new features, and special NFT rewards. For example, the JPMORGAN token’s staking tiers offer increasing APY and special benefits like enhanced voting power and premium NFT drops based on the minimum stake and lock period. This provides a new avenue for generating passive income from digital assets.

Decentralized Finance (DeFi) and Lending

NFTs are playing a growing role in DeFi, particularly in lending and borrowing protocols. Unique and valuable NFTs can be used as collateral for loans, unlocking liquidity for illiquid assets. This allows owners of high-value digital collectibles to access capital without having to sell their assets. Similarly, NFTs can represent fractional ownership of real-world assets, enabling more accessible and liquid investment opportunities in areas previously exclusive to a select few.

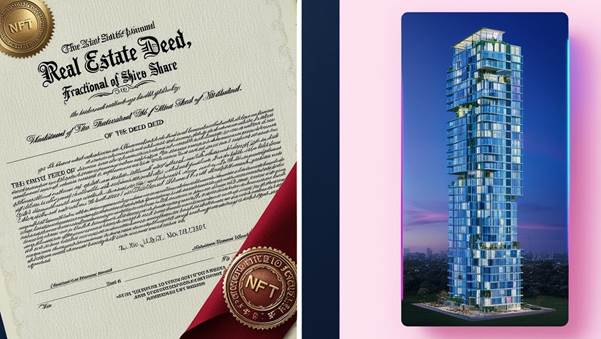

Real-World Asset Tokenization

One of the most promising applications of NFTs in finance is the tokenization of real-world assets. This involves representing tangible assets like real estate, art, or commodities as NFTs on a blockchain. This process can significantly increase liquidity, reduce transaction costs, and broaden access to investments that were traditionally illiquid and difficult to divide. Imagine owning a fractional share of a commercial building represented by an NFT – it becomes easily tradable and transparently verifiable.

Opportunities and Challenges for Traditional Finance

The emergence of NFTs presents both significant opportunities and notable challenges for traditional financial institutions.

Opportunities

- New Revenue Streams: NFTs can unlock new revenue streams through asset tokenization, digital art marketplaces, and innovative financial products.

- Enhanced Efficiency: The transparency and immutability of blockchain can streamline processes, reduce fraud, and lower operational costs in areas like record-keeping and asset transfer.

- Increased Accessibility: Tokenization via NFTs can democratize access to investments previously limited to a select few, fostering greater financial inclusion.

- Innovation and Competitive Advantage: Embracing NFT technology allows traditional financial institutions to stay at the forefront of digital innovation and maintain a competitive edge.

Challenges

- Regulatory Uncertainty: The evolving regulatory landscape for digital assets poses a significant challenge. Different jurisdictions may adopt contradictory approaches to digital asset regulation, necessitating continuous monitoring and adaptive compliance measures.

- Security Concerns: Despite robust security measures, smart contract vulnerabilities and sophisticated attacks remain a risk. Ensuring the security of NFT platforms and the underlying blockchain infrastructure is paramount.

- Scalability Issues: As NFT adoption grows, the underlying blockchain networks may face scalability, throughput, or fee issues during periods of high network congestion.

- Integration Complexities: Integrating blockchain technology and NFTs into existing legacy financial systems can be technically challenging and resource-intensive.

- Market Volatility: The nascent nature of the NFT market means it can be highly volatile, which presents risks for investors and institutions.

How do you think traditional financial institutions can best overcome the challenge of regulatory uncertainty surrounding NFTs?

Practical Tips for Engaging with NFTs in a Financial Context

For individuals and institutions looking to explore the financial potential of NFTs, here are some practical tips:

- Do Your Own Research (DYOR): Thoroughly investigate any NFT project or platform before investing. Understand its utility, the team behind it, and its long-term vision.

- Understand the Underlying Technology: Gain a basic understanding of blockchain technology and smart contracts to appreciate the security and functionality of NFTs.

- Start Small: Begin with smaller investments to familiarize yourself with the market dynamics and potential risks.

- Prioritize Security: Use strong, unique passwords, enable multi-factor authentication, and be wary of phishing attempts to protect your digital assets.

- Stay Informed on Regulations: Keep up-to-date with evolving regulatory frameworks in your jurisdiction to ensure compliance.

- Consider Diverse Use Cases: Look beyond speculative art NFTs and explore NFTs with practical utility in payments, loyalty programs, or real-world asset tokenization.

Real-World and Hypothetical Examples

Real-World Example: JPMorgan Token (JPMORGAN) and NFT Receipts

While the JPMORGAN Token is a community token inspired by JPMorgan, it illustrates a practical financial application of NFTs. The JPMORGAN token ecosystem implements NFTs as blockchain-based transaction receipts or payment records. This innovation allows users to generate immutable records of their transactions, which can be used for accounting, tax reporting, and verification purposes, bringing unprecedented transparency to financial operations. This move towards verifiable digital receipts could revolutionize how financial transactions are documented and audited.

Hypothetical Scenario: Fractionalized Real Estate Ownership

Imagine a luxury commercial building in a prime city location. Traditionally, investing in such a property would require significant capital and involve complex legal processes. With NFTs, the ownership of this building could be tokenized into thousands of fractional NFTs. Each NFT represents a small percentage of ownership. Investors could then buy and sell these fractional NFTs on a digital marketplace, making the investment more accessible and liquid. The smart contract governing these NFTs could automatically distribute rental income to holders and manage voting rights for building decisions. This democratizes real estate investment and offers a new pathway for diversification.

Key Takeaways

- NFTs are unique digital assets recorded on a blockchain, providing verifiable ownership and authenticity.

- They are non-fungible, meaning each is distinct and not interchangeable, unlike cryptocurrencies.

- Key characteristics like uniqueness, verifiability, immutability, and programmability drive their financial utility.

- NFTs are used for digital payment receipts, enhancing transparency in financial transactions.

- They power gamified loyalty programs and provide incentives for user engagement and long-term holding.

- NFTs are integrated into staking mechanisms, offering tiered rewards and boosted governance rights.

- Opportunities include new revenue streams, enhanced efficiency, and increased accessibility to investments.

- Challenges involve regulatory uncertainty, security concerns, scalability, and integration complexities.

- The JPMORGAN token ecosystem demonstrates a practical application of NFTs for transaction receipts.

Conclusion

Non-Fungible Tokens are far more than just digital collectibles; they are a powerful technological innovation with the potential to reshape various facets of the financial world. By providing verifiable ownership, enhancing transparency, and enabling new forms of digital interaction, NFTs are paving the way for a more accessible, efficient, and innovative financial ecosystem. As traditional finance continues to bridge with Web3 technologies, the role of NFTs will only expand, presenting exciting opportunities for both individuals and institutions.

The journey outlined in this whitepaper represents just the beginning of how traditional financial principles can be enhanced through blockchain technology. The JPMORGAN token ecosystem, through its focus on security, compliance, and user-centric design, serves as a compelling example of this future.

We invite financial enthusiasts, blockchain innovators, and forward-thinking investors to join this journey as we build the next generation of financial experiences, inspired by traditional excellence and enhanced by decentralized innovation.